There are two parties in a leasing agreement: the lessor and the lessee. There is a difference between lessor and lessee. A lessor is an entity that owns the asset and grants the lessee the right to use it. During the lease term, the lessor retains ownership rights and receives periodic lease rentals as agreed upon with the lessee. Unless the lessee exercises the option to purchase the item against the transfer price, possession of the asset is returned to the lessor at the conclusion of the lease period.

Definition of Lease

A lease is a written contract between two parties that spells out the lease’s terms as well as the leased property. The lessor is the owner of the leased property, while the lessee is the firm that rents the property. There are different types of leases, such as the gross lease, the net lease, the modified gross lease, financial lease or capital lease, operating lease etc.

Definition of Lessee

A lessee is an individual or entity to whom a lessor provides the right to use an asset or property for a specific period of time and makes one-time payments or series of payments to the lessor based on their initial lease agreement.

Important keynotes:

- The time period of the lease often largely depends on the type of asset or property. For example, a lease agreement for land to set up a factory may be for a longer period than an auto lease.

- The lessee is responsible for the maintenance of the asset or property during the lease period. The lessee does all the regular maintenance as necessary from his own sources.

- But if the leased property is an apartment, the lessee must take permission from the lessor for any structural changes.

- The lessee must repair damages before the expiry of the lease agreement. If he fails, the lessor has the right to deduct or charge the amount of the repairs to the lessee as per agreement.

Definition of Lessor

A lessor is someone who grants a lease to someone else (called lessee) under an agreement. The lessee makes rental payments over a certain period to the lessor for using the asset.

Important Keynotes:

- A lessor can be an individual or an entity

- Lessor is the owner of the asset or property.

- The lessor provides the right to use an asset or property to the lessee for a specific period.

- During the agreement period, the lessor has the right of ownership of the asset. The lessor receives one-time payment or a series of rental payments from the lessee. The lessor and lessee both are agreed on the rental payments on their initial lease agreement.

- If any losses are incurred during the agreement period are due to misuse of the asset, the lessee must compensate the lessor.

- The Lessor must authorize and be entitled to receive financial gains if the leased asset is sold.

- The lessor has limited access to the leased asset or property and needs the permission of the lessee to enter there. If any maintenance is to be done on the asset or property, he must inform the lessee about it before the actual time of visit.

- The Lessor has the right to evict the lessee and terminate the lease agreement if the lessee causes damage to the assets or commits illegal activities using the asset.

- The lessee must return the asset to the lessor on the expiry of the lease agreement. In some cases, the lessee may have an option to purchase the asset on expiry.

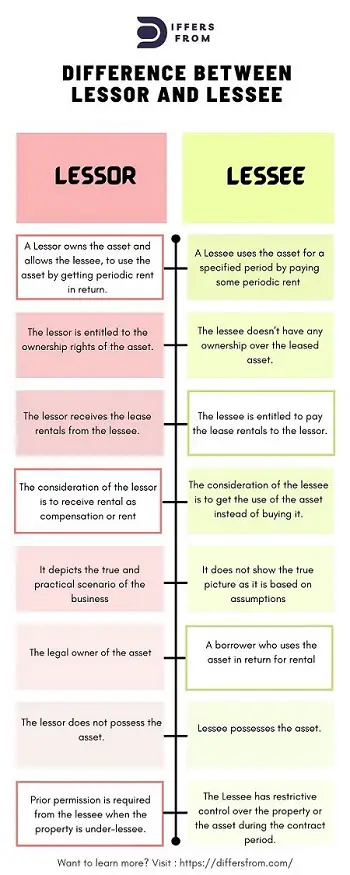

Difference between Lessor and Lessee

| Particulars | Lessor | Lessee |

| Definition | A person or company who owns the asset and allows the lessee, to use the asset by getting periodic rent in return. | A person or company who uses the asset owned by the lessor for a specified period by paying some periodic rent as per the terms of the agreement. |

| Ownership | The lessor is entitled to the ownership rights of the asset. | The lessee doesn’t have any ownership over the leased asset. |

| Lease rental | The lessor receives the lease rentals from the lessee. | The lessee is entitled to pay the lease rentals to the lessor. |

| Consideration | The consideration of the lessor is to receive rental as compensation or rent | The consideration of the lessee is to get the use of the asset instead of buying it. |

| Legal Status | The legal owner of the asset | A borrower who uses the asset in return for rental |

| Bankruptcy | The Lessor has the right to get the payment first in case of bankruptcy of the lessee. | The lessee is not related to the bankruptcy of the lessor |

| Asset Possession | The lessor does not possess the asset. | Lessee possesses the asset. |

| Use of asset | The lessor has not the right to use the asset as he is receiving a fixed rental. | The lessee carries all the rights to use the leased asset within the restrictions mentioned in the agreement. |

| Legal restrictions | The lessor has fewer legal restrictions because he is the legal owner of the asset. | The lessee has more legal restrictions, even as he needs to repair or compensate the lessor for any damage. |

| Restriction | Prior permission is required from the lessee when the property is under-lessee. | The Lessee has restrictive control over the property or the asset during the contract period. |

| Taxation | Due to ownership, the lessor has to pay the taxes against the income and the asset | The lessee is not the owner and uses the asset on a rental basis, therefore does not have to pay taxes. |

| Responsibility for the asset | Though the lessor is the owner of the asset, he will not be responsible for the repair or maintenance of the movable asset such as a car. In the case of a house or flat, the lessor is responsible for bearing the maintenance cost. However, it is mentioned in the lease agreement clearly. | As per the lease agreement, the lessee will be responsible for the maintenance and repair of the asset. |

| Other utility charges | The lessor is not responsible for utility payments. The clause of utility charges is clearly mentioned in the agreement. | During the lease agreement period, the lessee pays the utility payments. |

| Termination of contract | The lessor has the right to terminate the lease agreement in case of any damage is done to his property by the lessee | The lessee can also terminate the contract in case of an unknown event like a flood, fire etc. But it has to be mentioned in the agreement clearly. |

Lessor VS Lessee: Key Difference between Lessor and Lessee

- The lessor owns the asset and has the authority to transfer it to anyone. The lessee, on the other hand, is the temporary owner, and his ownership is limited to the scope of the contract and the agreed-upon payment.

- Possession is held by the lessee, but ownership is held by the lessor.

- If the lessee declares bankruptcy, the lessor is entitled to the payments first. Because the lessor owes the lessee no money, the lessee has no connection to the lessor’s bankruptcy.

- Because the lessor is the owner, he has no restrictions on how the property can be used. When the property is under-leased, however, authorization is necessary. The lessee has little control over the property or asset.

- The lessor receives payment in the form of lease or rent. The benefit to the lessee, on the other hand, is the temporary use of the asset without having to invest the whole quantity of money.

- The lessor has the right to cancel the contract if the lessee causes damage to his property or violates any of the contract’s terms. The lessee may also cancel the lease in the event of an unforeseen occurrence, such as a flood or fire.

- As the asset’s owner, the lessor has entire authority to remove the asset or property from the present lessee and lend it to another lessee. This privilege, however, is not extended to the lessee.

What are the advantages of lessor?

- The lessor receives periodic lease rents from which it not only recovers the cost of the asset but also earns profits.

- The lessor is allowed to claim tax advantages for costs such as asset depreciation, maintenance, and so on.

- Ownership is held by the lessor, and if the lessee fails to make payments, the lessor may repossess the item. As a result, the lessor bears less risk under this arrangement.

- Lease rentals are often higher than the installments paid by the lessor to the asset’s financier, resulting in a successful project for the lessor.

What are the disadvantages of Lessor?

- The lessor has to bear the risk of the asset’s obsolescence.

- The lessor is not allowed to demand additional lease rentals if the asset’s market value rises.

- Recovering the initial cost of the asset takes a long time.

- In the event of unexpected market changes, cash flows may be impacted, and the lessor may be unable to control cash flows in leasing projects.

What are the advantages of Lessee?

- Leasing or renting an asset for a certain length of time is a more cost-effective alternative than acquiring an actual item, which involves a large financial commitment.

- The lessee can finance the asset entirely through lease financing, avoiding even the initial outlay in margin money necessary under loan financing.

- Because technology is continually developing, lessees must accept the risk of obsolescence if they acquire the asset. With the lease, however, he may easily shift this risk to the lessor.

- Because the renter just utilizes the asset and does not own it, it does not appear on the financial statement.

What are the disadvantages of Lessee?

- Lease rentals can be raised if the cost of obsolescence is included; this raises the cost of asset financing.

- If the leasing firm goes bankrupt, the tenant may lose access to the leased asset.

- Because he is not the legal owner of the item, the renter cannot make significant modifications to it. If he purchases the asset, this is not the case.

- If the lessee quits the lease contract before the lease time expires, he must pay some fines.

What is the difference between a lessor and a landlord?

We already know who is lessor. Lessor is the legal owner of the asset or property.

There is a subtle difference between a lessor and a landlord. Before describing it, we may know the definition of a landlord.

Definition of Landlord

A landlord is a property owner who rents or leases out his or her property (mostly real estate property) to another party in exchange for rent payments. Individuals, corporations, and other entities can be landlords. During the rental time, landlords generally supply the required maintenance or repairs, while tenants or leaseholders are responsible for the cleanliness and general care of the property. A lease agreement will typically describe each party’s specific duties and obligations.

Difference between a lessor and a landlord

A lessor is the owner of the asset or property; it can be an automobile, machinery, or land.

But in the lease agreement, a lessor is also called a landlord if the asset is a land or house.

Is there a difference between a lease agreement and a rental agreement?

What is Lease Agreement?

A lease agreement between a lessor/landlord and a lessee or tenant grants the tenant the right to reside in a property for a set period of time, generally six or twelve months. The lease is bound by a contract between the landlord and the tenant.

The landlord and tenant agree to certain terms and conditions in a lease, such as the rent, pet regulations, length of the agreement, and so on. Neither side can modify the agreement unless the other agrees in writing.

Advantages of Lease Agreement:

- The lease is advantageous to both parties.

- It is against the lease agreement for a tenant to cease paying rent or depart the property during the lease period.

- Similarly, the landlord cannot evict the renter without cause. For example, if my sister moves to town, I won’t be able to evict one of my renters in order to make room for her. A lease has been signed by the renter. My options are limited.

What is Rental Agreement?

Lease agreements and rental agreements are quite similar. The duration of the contract is the most significant distinction between a lease and a rental agreement.

A rental agreement is a month-to-month contract. Both the landlord and the tenant have the option to alter the conditions at the conclusion of each 30-day period.

The landlord has the option of increasing the rent, offering the room to someone else, or enacting a “no-dog” policy. Similarly, the tenant has the freedom to pack her belongings and relocate.

Unless either party provides the other “due notice,” as specified by the terms of the agreement and local regulations (for example, 30 days’ notice, 60 days’ notice, etc. ), rental agreements generally renew automatically at the conclusion of each 30-day period.

Advantages of Rental Agreement:

- Rental agreements allow both parties the option of living on a month-to-month basis.

- A tenant has the option of staying at a different location for one or two months.

- A landlord, on the other hand, may simply require tenant occupancy for a few months before beginning repairs in the spring.

One caveat: the rules governing leases and rental agreements vary by state, county, and municipality. Some areas have “rent control” legislation, whereas others do not. During a month-to-month arrangement, some jurisdictions allow one partner to give the other 30 days’ notice; others demand greater notice.

Difference between a Lease agreement and a Rental agreement

| Lease Agreement | Rental Agreement |

| Long Term | Short Term |

| Does not renew automatically at the end of a contact | Renew automatically at the end of each 30-day period. |

| A lease provides both parties with more long-term security | A rental agreement gives you greater flexibility. |

| For tenants who wish to build a “home,” leases are ideal. | Rental agreements are suitable for those who require temporary housing during a period of change. |

Why are a lease agreement and rental agreement usually done?

A lease agreement and rent agreement spells out each party’s responsibilities for carrying out and maintaining the agreement, and they are enforceable by both parties. A residential property lease, for example, includes the property’s address, landlord responsibilities, and tenant responsibilities, such as the rent amount, required security deposit, rent due date, consequences for breach of contract, lease duration, pet policies, and any other pertinent information.

Different types of Lease agreements

Building Lease

A building lease, according to Black’s Law Dictionary, is a long-term covenant (lease) that allows a lessee to construct and own edifices (big structures) on the lessor’s property.\

Rent to own Lease

A lease that allows you to rent to own is known as a rent-to-own

A rent-to-own lease allows a lessee to put his or her weekly or monthly payments toward the purchase of a physical item. Unlike typical leases, a rent-to-own lessee has the option of acquiring the asset outright or returning it to the owner at the conclusion of the lease term.

Prepaid Lease

Prepaid leases differ from rent-to-pay agreements in that they require lessees to pay in advance for long-term use (no more than 80% of an asset’s useful life). A lessee may acquire an asset at the current value at the end of a prepaid lease.

Capital Lease of Finance lease

A capital lease (also known as a “financial lease” or “finance lease”) is a long-term arrangement that allows a lessee to profit financially from an asset without taking complete ownership. Although the lessee’s payment (lease payment) schedule must account for 90% or more of the asset’s market value at the lease commencement, the lessor serves as a financier in this respect.

Operating Lease

An operating lease has similar to a capital lease in that it does not require the lessee to report the asset as a deduction on their financial statements. In an operating lease, there are no ownership incentives. Despite the fact that operating leases do not provide bargain purchase options, the lessee’s regular payments are less than 90% of the asset’s original market value and do not exceed 75% of the asset’s economic life.

Sale and Leaseback

An original lease asset owner and a financing entity, such as an investor, insurance company, or leasing business, enter into a sale and leaseback arrangement. When an entity purchases an asset with the intention of leasing it back to the original owner, this is known as a “sale and leaseback.”