For many aspiring business executives, the difference between accounting profit and economic profit has been very unclear. This article will clear up some of the confusion by presenting some important concepts and difference between accounting and economic profit.

What is Accounting Profit?

Accounting profit is a measure of performance for a business entity, which represents how much money a company has made after meeting its expenses and paying taxes. Accounting profit is the difference between revenue and costs, including depreciation. This is the basis for taxes, dividends, and valuation.

You can buy assets or shares of assets; ideally, you buy assets at low prices on a per-share basis. Accounting profit doesn’t take into account economic profit, which is calculated by adding depreciation to accounting profit.

You may find the figure of accounting profit at the bottom of the company’s income statement. It is the net income that a company generates in a financial year.

Calculation of Accounting Profit:

Accounting profit = Revenue – Cost of Goods Sold – Operating expenses

Or Accounting profit = Total revenue – explicit cost

Common sources of revenue: Sales revenue from goods and services, receipt of dividends or interest, rental income, etc.

Common types of expenses: Cost of goods sold (COGS), marketing and advertising expenses, salaries and benefits, travel, entertainment, sales commissions, rent, depreciation and amortization, interest, taxes, etc.

Here, it is important to understand the explicit cost and implicit cost concepts to understand better the key differences between accounting profit and economic profit.

Implicit Cost:

An implicit cost is an opportunity cost and other non-monetary expense incurred by utilizing assets or resources that a business already owns. These costs are non-monetary because there is no actual payment by the business for the use of the existing resource.

Examples of implicit costs are: Time spent training a new employee, Time and resources used creating displays, opportunity cost, etc.

Explicit Cost:

Explicit costs are the operating costs or expenses which are easily quantifiable and identifiable. These expenses are deducted from gross income to determine the net income of a company for a financial year. Examples of explicit costs are Salaries and wages, Rental expenses, etc.

For calculation of accounting profit, Only explicit costs are taken into account. These include the cost of goods sold, marketing and advertising expenses, administration expenses, salaries and wages, commissions, rent, depreciation and amortization, interest, and taxes. These are direct costs, meaning directly impacting the cash flow statement of a firm.

What is Economic Profit?

Economic profit is a company’s total revenues minus the cost of the factors of production, including labor and capital. For example, if a widget company sells $1 million worth of widgets and pays $750,000 for the labor (salaries) and capital (machinery and equipment) to produce them, it would have $250,000 in economic profit.

In other words, Economic profit is the difference between revenue and opportunity cost. Opportunity cost is the value of an alternative, given up in order to get something else. In accounting, this would be the difference between revenue and the cost of the resources used in production. In economics, this would also include the opportunity cost of the resources invested by the owner. It’s a measure of the economic return on investment of an enterprise.

Calculation of Economic Profit

Accounting profit is not the same as economic profit. As previously stated, accountants examine only the explicit cost, whereas economists consider both the explicit and implicit cost when calculating economic profit. So, after reducing economic costs (explicit and implicit costs) from a corporate entity’s total revenue, we get economic profit.

The economic expenses of a corporate organization, according to economists, are the opportunity costs of the resources employed, regardless of whether those resources are provided by others or by the business itself.

Economic profit = Total revenue – Economic costs

Or

Economic profit = Total revenue – (Explicit costs + Implicit costs)

Or

Economic profit = Accounting profit – Opportunity costs

Let’s look at an example to help you understand. A company organization has a profit of $50000 in accounting. After paying individuals and other businesses for the materials, labor, and capital they provided, this profit is realized. This profit, however, ignores the hidden cost ( forgone income on own financial capital, building, and labor provided by the owners).

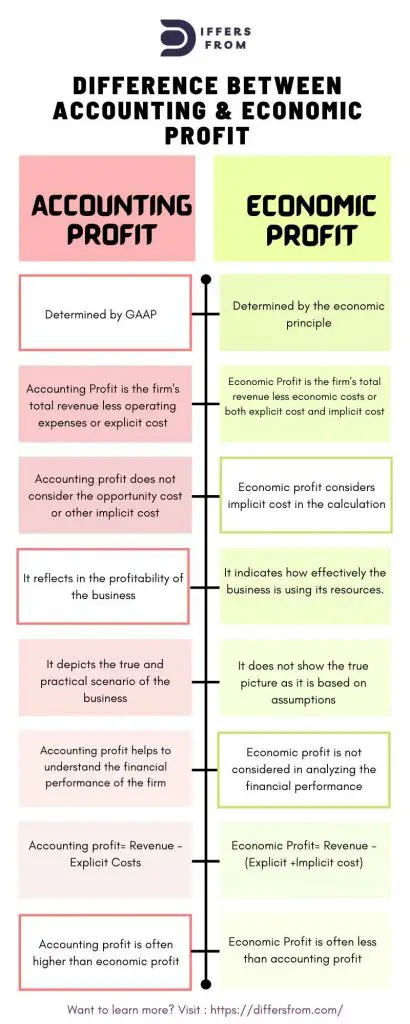

Difference between Accounting and Economic Profit

| Accounting Profit | Economic Profit |

| Determined by GAAP | Determined by the economic principle |

| Accounting Profit is the firm’s total revenue less operating expenses or explicit cost | Economic Profit is the firm’s total revenue less economic costs or both explicit cost and implicit cost |

| Accounting profit does not consider the opportunity cost or other implicit cost | Economic profit considers implicit cost in the calculation |

| This term is mostly used by the accountants | This term widely used by the economist |

| It reflects in the profitability of the business | It indicates how effectively the business is using its resources. |

| It depicts the true and practical scenario of the business | It does not show the true picture as it is based on assumptions |

| Accounting profit helps to understand the financial performance of the firm | Economic profit is not considered in analyzing the financial performance |

| Accounting profit= Revenue – Explicit Costs | Economic Profit= Revenue – (Explicit +Implicit cost) |

Accounting vs Economic Profit in Infographic

Key Difference between Accounting Profit and Economic Profit

- The accounting profit is the profit realized by a firm for a specific financial year. Economic profit, on the other hand, is defined as the profit earned by a company over and above its expenses, which are commonly referred to as opportunity costs.

- Accounting profit is often higher than economic profit since economic profit is calculated using various assumptions and the re-use of multiple revenue and cost categories.

- If an organization’s accounting profit is less than its hidden expenses, it is likely to make a negative economic profit.

- Accounting profit is calculated by subtracting leasing expenditures, depreciation or non-cash expense, and reserves for capital investment, whereas economic profit may include opportunity costs, salvage or residual values, inflation charges, taxation rates, and interest imposed or applied on cashflows.

- Economic profit is defined as income received after all economic costs have been deducted. Revenues earned over and above opportunity costs result in economic profit. Accounting profit is typically relied on by accountants since it accounts for production expenses and their total influence on earning potential.

- The economist always depends on economic profit because it explains how the firm used its resources and assessed the opportunity costs in order to generate a positive economic profit. In general, the business contains a goal to make a larger economic profit. When accounting gains exceed total implicit expenses, the economic profit is typically positive.

- If a company’s accounting profit is less than its hidden expenses, it will generate a negative economic profit. It is typically advised that a firm disposes of itself if it makes negative economic earnings.

- Accounting profit is recognized by accounting principles and economic profit is determined by economic principles.

What is the difference between accounting cost and economic cost?

Accounting cost is a calculation of how much it costs to produce a product. A company’s accounting profit is the difference between the revenue they bring in and the cost to produce that product. Businesses that are interested in pricing their product are often interested in accounting for profit. To illustrate this, consider a company that spends $10 per unit on raw materials to produce a product. The company sells the product for $15.

The economic cost is the total value of the resources that are used up by production, which can include labor, capital, and natural resources. For example, if an automobile manufacturer produces 10,000 cars at a cost of $5 million each, then the economic cost is $50 million. A portion of that economic cost is the value of the natural resources (petroleum, copper, rubber, wood, etc.) that are consumed during production.