What is the ultimate objective of a business? Profit and there shall not any confusion on this. But surprisingly, not all finance managers do not agree with this. Some of them prefer to maximizing wealth rather than maximizing profit. Why? Let’s read the difference between profit maximization and wealth maximization and know why businesses prefer wealth maximization.

Before going into the difference between profit maximization and wealth maximization concepts, we may discuss some important concepts. The main objective of finance is to maximize the owner’s economic welfare in the form of increasing the stock price in the stock market. The objective of Financial Management can be divided into three categories:

- Maintain liquid assets

- Profit Maximization

- Shareholder’s wealth maximization

What is Maintaining liquid assets?

Maintaining liquid assets adequately to meet the organization’s present and future obligations is one of the main objectives of financial management. It may be to noted that the Finance manager shall invest in liquid assets adequately, neither too low nor too excessive. A finance manager shall maintain the balance between liquidity and profitability.

What is profit maximization?

A business is an economic institution that must earn profit to cover its costs and provide funds for growth. Profit maximization is a traditional and narrow approach for maximizing the profit of the business concern using the existing resources and ignoring the fact of the associated risk.

Feature of Profit maximization

- Profit is an important factor to choose investment proposal. When a new idea is established, the first fact tha firm consider is profit. If the proposal is will not bring enough profit, frim reject the proposal.

- Firms set the products price and output in such a way that they bring maximum returns

- Firms tend to reduce their cost of capital and other expenses so that they can achieve maximum profit.

- EPS can be a measurement tool of the profit of a business.

Favorable arguments for profit maximization

- Profitablity is one of the true measures of financial stability

- A business’s ultimate aim is to earn profit.

- It helps the firms to maintain liquidity.

- It leads to maximum exploitation of financial resources

- Net income act as a major source of long term finance.

The drawback of profit maximization

- The term profit is vague, ambiguous and it cannot be precisely defined. Maximizing profit can be interpreted differently by different people. For example, it can be short-term profit for some people and long-term profit for some.

- It does not consider the time value of money.

- It does not also consider the net present value of the cash inflow.

- It does not consider the risk of potential earning stream

- The effect of the dividend policy on the stock market is also not considered in profit maximization theory.

- It leads to inequality among shareholders.

- And most importantly it may encourage unsocial, unethical, and bad earning habits, and its corrupt practices and unfair trade.

What is wealth maximization?

Wealth maximization is the theory of increasing the value of an organization by increasing the value of the market price of shares held by the stakeholders gradually.

The term “wealth” refers to the shareholder’s wealth. In a firm, a shareholder’s wealth is the shares of the firm. So, the price of shares increased in the market, the value of the wealth is also increased.

This concept allows mitigating the loss or any associated risk while bringing the highest possible returns from the investment. This is also known as value maximization or net present worth maximization.

Features of Wealth maximization

- The most direct evidence of wealth maximization is changed in the price of a company’s shares.

- It is mainly achieved throughout the long-term

- The price of the shares of the organization is the performance indicator of the organization.

- It also indicates the performance of assigned management on behalf of the shareholder.

Favorable arguments for wealth maximization

- It overpowers the limitation of the policy of profit maximization

- It serves the interest of all stakeholders such as suppliers, investors, employees, management, consumers etc.

- It is based on the concept of cash flow. Cash flow means numbers, so it does not rely on any assumptions.

- It is distinct and simple to understand concepts.

- It considers the time value of money.

- It also considers the risks of the investment

- It promotes optimum and efficient utilization of resources.

The drawback of wealth maximization

- It ignores short-term economic benefits.

- It does not consider the unstable share market.

- It may create agency problems between management and shareholders.

Difference between Profit Maximization and Wealth Maximization

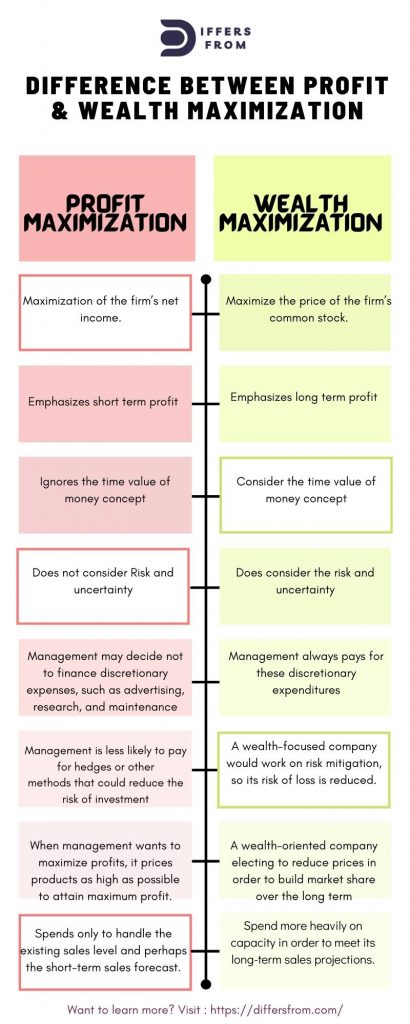

| Profit Maximization | Wealth Maximization | |

| Focus | Maximization of the firm’s net income. | Maximize the price of the firm’s common stock. |

| Emphasize | Emphasizes short term profit | Emphasizes long term profit |

| Time Value of Money | Ignores the time value of money concept | Considers the time value of money concept |

| Risk | Does not consider Risk and uncertainty | Does consider the risk and uncertainty |

| Planning Duration | The immediate increase of profits is dominant, so management may decide not to finance discretionary expenses, such as advertising and publicity, research, and maintenance | Management always pays for these discretionary expenditures. |

| Risk Management | Management always looking for minimizing expenditures, so it is less likely to pay for hedges or other methods that could reduce the risk of investment. | A wealth-focused company would work on risk mitigation, so its risk of loss is reduced. |

| Pricing Strategy | When management wants to maximize profits, it prices products as high as possible to attain maximum profit. | A wealth-oriented company electing to reduce prices in order to build market share over the long term. |

| Capacity Planning | A profit-oriented business spends only to handle the existing sales level and perhaps the short-term sales forecast. | A wealth-oriented business will spend more heavily on capacity in order to meet its long-term sales projections. |

Profit Maximization VS Wealth Maximization

What Goal Should business peruse?

- The primary goal of a firm might differ depending on the nature of the business. But usually, every business owner wants to increase the value of his or her investment in the firm

- In the proprietorship business, the owner has direct control over his or her investment. Because it’s a sole proprietorship business and he or she runs the business, as a result, a proprietor may choose to work four days per week and play golf for the rest of the week; if the business remains successful or he is enjoying the life this way.

- On the other hand, the investors (stockholders) of a large organization or company have very little control over their investments. In a company, investors generally do not run the business. They appointed a management team for working on their behalf. They are not involved in the day-to-day decisions and expecting that the management team who run the business do so with the best interests of the investors in mind.

- The investors buy the shares of a company to earn an acceptable return on the money they invest. They want to increase the wealth positions as much as possible.

- For this reason, according to Basley & Bringham that management’s primary goal is stockholder wealth maximization, which, as we will see, translates into maximizing the value of the firm as measured by the price of its common stock.

- Firms may have other objectives: In particular, the management team who makes decisions and run the business may interest to increase personal satisfaction, in their employees’ welfare, and in the good of the community and of society at large. Still, maximizing the share price in the market is the most important goal of most corporations.

In this article, we write thoroughly about the difference between profit maximization and wealth maximization from the perspective of financial management. You may share your thoughts and share the article with your friends!