“Debentures are bonds in certain ways, but not all bonds are debentures. A debenture is a term used to describe an unsecured bond.

This is the American definition of a debenture, which adds to the confusion. A debenture is a bond that is backed by firm assets in British use. The names are interchangeable in certain countries.”

Confusing! Right? In this article, the research team of Differs From hits the high spots of the difference between bonds and debentures and clarifies all the confusions.

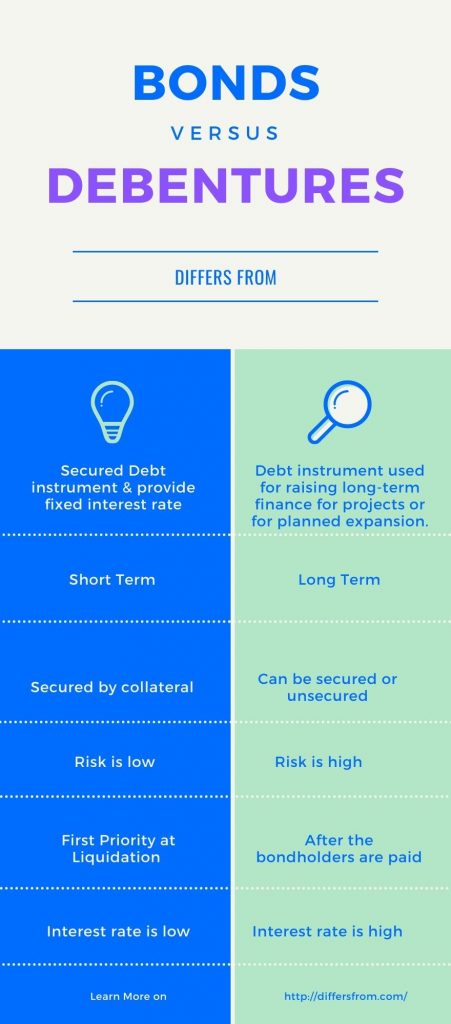

Bonds and debentures both are fixed-income debt instruments. These instruments are issued by corporations and the government. But bonds have lower interest rates and are generally secured by collateral. On the contrary, debentures, are the debt instruments that are used to raise long-term finance. Debentures are issued by public companies. The difference between bonds and debentures is briefly discussed in this article.

What is Bond?

- Bonds are units of corporate debts which are issued by companies and traded as assets.

- It is a fixed income instrument. It pays the holders a fixed interest rate, which is also known as coupon. Now a days, variable or floating interest rates are becoming increasingly popular.

- Bond prices and interest rates are inversely related: as interest rates rise, bond prices fall, and vice versa.

- Bonds have maturity dates and after maturity, the principal must be paid in full or the bond will default.

What is Debenture?

- A debenture is a financial instrument which is not backed by any assets. Generally, it has a tenure of more than ten years.

- It is only secured by the issuer’s soundness of assets and reputation in the market.

- It is regularly issued by enterprises as well as governments to raise cash of funds.

- Some of debentures can be converted into equity shares.

Bond vs Debentures: What’s the difference between them?

Every business requires funds to get started as well as run the operations smoothly. These funds can be raised using debt instruments or equity instruments. Most companies prefer to use debt instruments instead of equity instruments. Among these debt instruments, bonds and debentures are the most common debt financing options.

Despite many thinks both are similar and often uses interchangeably, debt and debenture have distinct differences. In the above, we have discussed some key points of bonds and debenture, and get insights about the definitions and differences.

The main difference between bond and debenture is a bond is fundamentally a loan backed by a specific physical asset and a debenture is a debt security issued by a corporation that is not backed by assets but rather by the company’s credit rating. Both governments and private enterprises choose this method of communication.

Debentures typically are issued to raise capital to meet the expenses of an upcoming project or to pay for a planned expansion in business

Difference between Bonds and Debentures?

| Bonds | Debenture | |

| Meaning | The bond is a debt instrument used by private corporations and by governments that are secured and provide a fixed interest rate | It is an instrument used for raising long-term finance for upcoming projects or for planned expansion. |

| Tenor | Bond is for shorter-term | A debenture is for longer-term |

| Secured | Secured by collateral | Can be secured or unsecured |

| Issuer | Financial Institutions, Corporations, Government agencies, etc | Public companies and government |

| Risk | Low | High |

| Priority at Liquidation | First priority | After the bondholders are paid |

| Interest Rate | Usually, low | The high rate of interest |

| Payment structure | Accrued | Periodical |

| Convertible to Equity Shares | Does not | It does |

| Calculations | Bonds= Assets – (liabilities+ Shareholder’s reserve+ Debentures) | Debentures = Assets – (Liabilities+ Shareholder’s reserve+ Bonds) |

Key difference between debenture and bond

- Bonds are often issued at the start of a firm, whereas Debentures are issued as the business grows.

- Bonds are backed by a collateral, security, or physical object, whereas Debentures are secured by the issuer’s promise.

- In the case of Bonds, the principal amount is repaid after the maturity period. In the event of a Debenture, the principal amount is returned once the project generates revenue.

- The interest rate on a debenture is greater than on a bond.

- The Tenure of Bonds is longer than that of Debentures.

- When compared to Debentures, the risk factor for bonds is smaller.

- Bonds are paid on a regular basis; for example, they might be paid in numerous installments. Debenture, on the other hand, is paid when a company needs money.

- In compared to Debenture-holders, Bondholders have the most authority in claiming the assets of the firm following liquidation.

Learn more about the Bond vs Debenture

Still, have some confusion? Then, read the below discussion:

How Debentures are different from Bonds?

Debentures are different from bonds in that they have a specified purpose. While both are used to obtain finance, debentures are often issued to cover the costs of an impending project or to fund a projected corporate development.

How do Debenture holders are received interest?

Investors will get a variable or fixed-interest coupon rate return on their debentures, as well as a repayment deadline.

When debenture holders are paid if interest is due?

When the interest payment is due, the corporation will usually pay the interest before paying dividends to shareholders.

How debenture is structured?

The corporation has two broad options for repayment of principal on the due date. They have the option of paying in one big sum or in installments. A debenture redemption reserve is an installment plan in which the corporation pays the investor a certain amount each year until the bond matures. The underlying documentation will provide a list of the debenture’s terms.

Why debenture is called a revenue bond?

Because the issuer plans to repay the loans from the revenues of the business endeavor they helped fund, debentures are also known as revenue bonds.

Why do companies issue debentures?

Companies issue debentures for long-term projects or for expansion of the business. Debentures are unsecured and are solely backed by the underlying company’s financial sustainability and trustworthiness. These debt instruments have an interest rate attached to them and are redeemable or repayable on a specific date.

What is a bond in finance in simple terms?

The most frequent sort of financial instrument employed by private companies and governments is the bond. It acts as a promissory note between the issuer and the investor. An investor lends a quantity of money in exchange for the prospect of repayment at a later period. Over the course of the bond’s tenure, the investor usually gets periodic interest payments.

Are bonds safer than stocks?

Bonds are typically regarded as a pretty secure investment in the investing world. Corporate or government bonds with high ratings have a low chance of default. However, each bond, whether issued by a government agency or a municipality, will have its own credit rating.

Why you should purchase bonds?

Bonds are generally regarded as secure, though unspectacular, investments that provide a guaranteed rate of return. Professional financial advisers often advise their clients to retain a certain amount of their assets in bonds and to raise that percentage as they near retirement age.

Are debentures safe?

A debenture’s lack of security does not always make it riskier than any other bond. A U.S. Treasury bond and a U.S. Treasury bill are both debentures in the strictest sense. They are risk-free since they are not backed by collateral.

Debentures, on the other hand, are the most prevalent long-term debt instrument issued by businesses. A corporation may issue bonds to generate funds in order to grow its retail store count. It plans to repay the loan with proceeds from future sales. The bond is regarded as having the same creditworthiness as the corporation that issued it.

Bonds and debentures allow businesses and governments to borrow money in addition to their regular cash flow.

Share your thoughts with us!

And don’t forget to share the post with your friends!